Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

From the technical level of the global Electronic Ceramics industry, Japan and the United States are in a leading position in the world. Among them, Japan, with its super-scale production and advanced preparation technology, has a dominant position in the world electronic ceramics market, accounting for more than 50% of the world electronic ceramics market. The United States has a strong force in basic research and new material development, and it pays attention to the cutting-edge technology of products and applications in the military field, such as underwater acoustic, electro-optic, optoelectronics, infrared technology and semiconductor packaging. In addition, the rapid development of South Korea in the field of electronic ceramics has attracted attention.

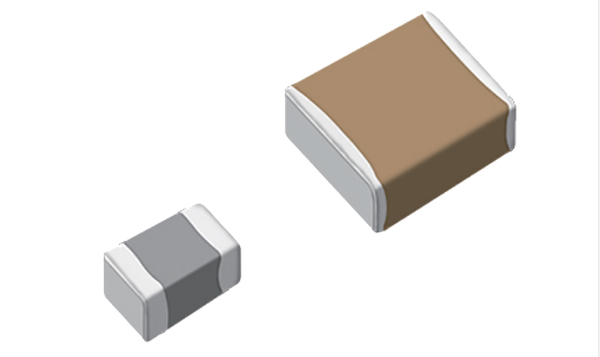

The main application area of electronic ceramics is passive electronic components. MLCC is one of the most used passive components, mainly used in all kinds of electronic machine oscillation, coupling, filter bypass circuit, its application fields involve automatic instrumentation, digital home appliances, automotive appliances, communication, computer and other industries. MLCC occupies an increasingly important position in the international electronics manufacturing industry, especially with the increasing demand from consumer electronics, communications, computers, networks, automotive, industrial and defense end customers, the global market reaches billions of dollars, and is growing at a rate of 10% to 15% per year. Since 2017, there have been several price increases for MLCC products due to supply and demand.

Chip inductors are another type of passive electronic components with a large amount demand, and are the most technologically complex of the three categories of passive chip components, and the core material is magnetic ceramics (ferrite). At present, the total demand for chip inductors in the world is about 1 trillion, and the annual growth rate is more than 10%. In the development and production of chip inductors, Japan's production output accounts for about 70% of the world's total. Among them, TDK-EPC, Murata and Suntrap Co., Ltd. have always mastered cutting-edge technologies in this field. According to the Industry Intelligence Network (IEK) statistics, in the global inductance market, TDK-EPC, Suntrap Co., LTD., and Murata three companies together account for about 60% of the global market. The main trends in the development of chip inductors include small size, high inductance, high power, high frequency, high stability and high precision. The core of the technology is soft magnetic ferrite and medium material with low temperature sintering characteristics.

Piezoelectric ceramics are an important energy exchange material with excellent electromechanical coupling properties. They are widely used in electronic information, electromechanical energy exchange, automatic control, MEMS and biomedical instruments. In order to meet the new application requirements, piezoelectric devices are developing in the direction of multilayer, chip and miniaturization. In recent years, some new piezoelectric devices such as multi-layer piezoelectric transformer, multi-layer piezoelectric driver and chip piezoelectric frequency device have been developed and widely used in electrical, electromechanical and electronic fields.

At the same time, in terms of new materials, the development of lead-free piezoelectric ceramics has made great breakthroughs, which may make lead-free piezoelectric ceramics replace lead zirconate titanate (PZT) based piezoelectric ceramics in many fields, and promote the upgrading of green electronic products. In addition, the application of piezoelectric materials in next-generation energy technologies is beginning to emerge. In the past decade, with the development of wireless and low-power electronic devices, the research and development of micro-energy harvesting technology using piezoelectric ceramics has received great attention from governments, institutions and enterprises.

Microwave dielectric ceramics are the cornerstone of wireless communication devices. Widely used in mobile communications, navigation, global satellite positioning system, satellite communications, radar, telemetry, Bluetooth technology and wireless local area network (WLAN) and other fields. Components such as filters, resonators and oscillators composed of microwave dielectric ceramics are widely used in 5G networks, and their quality largely determines the final performance, size limits and cost of microwave communication products. Microwave electromagnetic dielectric materials with low loss, high stability and modulability are currently the core technology in the world. Microwave dielectric ceramic materials in the early stage of development had formed a fierce competition in the United States, Japan, Europe and other countries and regions, but then Japan gradually in a clear dominant position. With the rapid development of the third generation mobile communication and data microwave communication, the United States, Japan and Europe have made strategic adjustments for the development of this high-tech field. From the recent development trend, the United States takes nonlinear microwave dielectric ceramics and high dielectric constant microwave dielectric Ceramic material technology as a strategic focus, Europe focuses on fixed frequency resonator materials, and Japan relies on its industrial advantages to vigorously promote the standardization and high quality of microwave dielectric ceramics. At present, the production level of microwave dielectric materials and devices is the highest in Japan's Murata, Kyocera Co., LTD., TDK-EPC Company, and Trans-Tech Company in the United States.

Semiconductor ceramics is a kind of information function ceramic materials that can convert physical quantities such as humidity, gas, force, heat, sound, light, and electricity into electrical signals, which is widely used and is the main basic material of Internet of Things technology, such as positive temperature coefficient thermistor (PTC), negative temperature coefficient thermistor (NTC) and varistor, as well as gas and humidity sensitive sensors. The output and output value of thermal and pressure sensitive ceramics are the highest in semiconductor ceramic materials. Internationally, thermistor ceramic materials and devices to Japan Murata, Shiura Electronics Co., LTD., Mitsubishi Group (Mitsubishi), TDK-EPC, Ishizuka Electronics Co., LTD. (Ishizuka), VISHAY (VISHAY), Germany EPCOS (EPCOS) and other companies are the most advanced ceramic technology, the largest output, Their total annual output accounts for about 60% to 80% of the world's total, and their products are of good quality and high prices. In recent years, foreign ceramic semiconductor devices are developing in the direction of high performance, high reliability, high precision, multilayer chip and scale. At present, some giants of Technical Ceramics have launched some chip semiconductor ceramic devices based on multi-layer ceramic technology, which have become high-end products in the field of sensitive devices.

LET'S GET IN TOUCH

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.